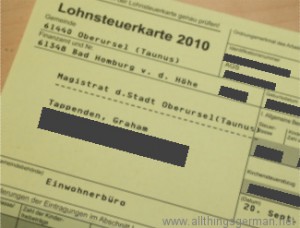

One of the first places for anyone arriving in Germany to live has to go to is the Einwohnermeldeamt. Having registered an address and applied for the relevant permits to stay in the country, new residents used to receive their Lohnsteuerkarte – a card that shows the details that an employer needs to calculate income tax deductions, such as the tax class (Steuerklasse), religion and the number of children in the family.

One of the first places for anyone arriving in Germany to live has to go to is the Einwohnermeldeamt. Having registered an address and applied for the relevant permits to stay in the country, new residents used to receive their Lohnsteuerkarte – a card that shows the details that an employer needs to calculate income tax deductions, such as the tax class (Steuerklasse), religion and the number of children in the family.

The Lohnsteuerkarte was valid for one year, and the new card for the coming year used to be sent out around the end of September.

But all that has now changed – or at least it should have done if a new system had come in at the beginning of this year. Instead, there are special rules that apply only in 2011!

It all started a few years ago, when we all received a so-called Steuer-Identifikationsnummer – a unique 11-digit number that never changes, unlike the current system of Steuernummern which change when you move to a different area. Unlike the old system, even children are issued with one automatically, and the number is valid for up to 20 years after you die!

Using the new number, employers are supposed to access the central tax database (ELStAM) and look up the details that were previously on the Lohnsteuerkarte.

Except that the new system is not ready yet and as no new cards were printed in September, the old cards that were issued in September 2009 remain valid for 2011.

Which just leaves the problem of anyone entering the job market for the first time this year.

They will have to go to their local Finanzamt (tax office) to apply for written confirmation of their tax status.

Anyone changing their tax class, eg. by getting married, will also have to go there to have their cards amended.

The old system had been in place since 1925, with the Lohnsteuerkarte pretty much unchanged since 1953. Perhaps it should have stayed that way?

Speak Your Mind