The New Year in Germany usually brings with it some new regulation or law, or simply a rise in prices. 2013 sees a whole range of things changing, but many of them will only affect a small percentage of the population.

The New Year in Germany usually brings with it some new regulation or law, or simply a rise in prices. 2013 sees a whole range of things changing, but many of them will only affect a small percentage of the population.

The following 4, however, are likely to affect most people.

1. The price of stamps

The cost of sending a normal letter (up to 20g and 23.5 x 12.5 x 0.5cm) within Germany went up from 55 cents to 58 cents. The cost of sending the same letter abroad stayed at 75 cents, and the prices for postcards stayed the same as well. Larger items up to 1kg and 35.3 x 25 x 5cm now cost €2.40 to send within Germany instead of €2.20.

The cost of sending a book as a “Büchersendung” went up from 85 cents for 500g to €1, and from €1.40 for 1kg to €1.65. The lower weight bands have been scrapped. Similarly, “Warensendung” up to 50g now costs 90 cents and up to 500g costs €1.90. These two special postal services are often used by people selling on ebay.

2. The doctors’ quarterly fee

The so-called “Praxisgebühr“, introduced in 2004 and payable each quarter at a rate of €10 if you were treated by a doctor or dentist (not just there for a check-up), has been scrapped.

This means that you no longer have to go back to the same doctor within the quarter, just to get a transfer slip (“Überweisung”) to a different type of doctor.

3. The television and radio license fee

Each household now pays a flat fee per quarter for their television license, regardless of how many televisions or radios they have, or how many people with their own income live in the household. Even households who do not own a television or radio are required to pay, with exemptions only being made in very exceptional circumstances (such as for people who are both deaf and blind).

New rules also apply for businesses.

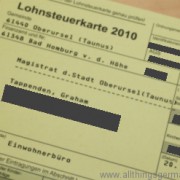

4. The tax card

Finally, the digital tax card (“Lohnsteuerkarte”) has arrived. Anyone now registering on arrival in Germany will have a “Steueridentifkationsnummer”, abbreviated as “IdNr”, sent to them by post by the “Bundesamt für Steuern”. This number needs to be given to their employer so that they in turn can retrieve the relevant tax information from the tax office using the new ELStAM system before they pay any wages. Previously they used the information printed on the tax card.

Frohes Neues Jahr!

Speak Your Mind